Strategy & Sustainability: Can it be a love match?

Blog

Why we need to start this love journey

Businesses cannot thrive in societies that fail. Today’s societal challenges are directly intertwined with business continuity. The ability to anticipate, absorb, and adapt to these challenges while still delivering on strategic goals is the essence of organizational resilience. A strong strategy therefore acknowledges this mutual dependency: business success and societal well-being reinforce each other. However, many companies still find it difficult to integrate sustainability into their core business. Research shows that a lack of market pull, pressure on short-term financial performance, and a narrow focus on traditional KPIs often hold organizations back. Yet evidence shows that companies with strong social and environmental performance tend to achieve better financial outcomes, when sustainability is embedded within strategic decision-making rather than positioned alongside it. In this blog, we build on insights from Prof. Dr. Rob van Tulder’s “Principles of Sustainable Business” to draw on lessons for strategic decision-making.

Which relationship best describes your company?

Based on an analysis of annual reports of Dutch companies, we explored how material ESG topics identified through Double Materiality Assessments are reflected in corporate strategy. This revealed several distinct approaches to strategic integration.

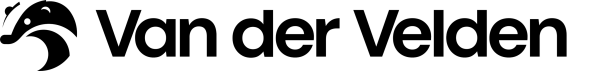

Company 1: Sustainability as a parallel layer of strategy

In this relationship, sustainability is not a strategic priority in itself but rather a parallel or adjacent layer of the agenda. Unilever for example positions sustainability as an adjacent layer of its corporate strategy, which is primarily financial and profit driven. The exact link between the sustainability priorities and the company’s overarching strategic goals is not clear.

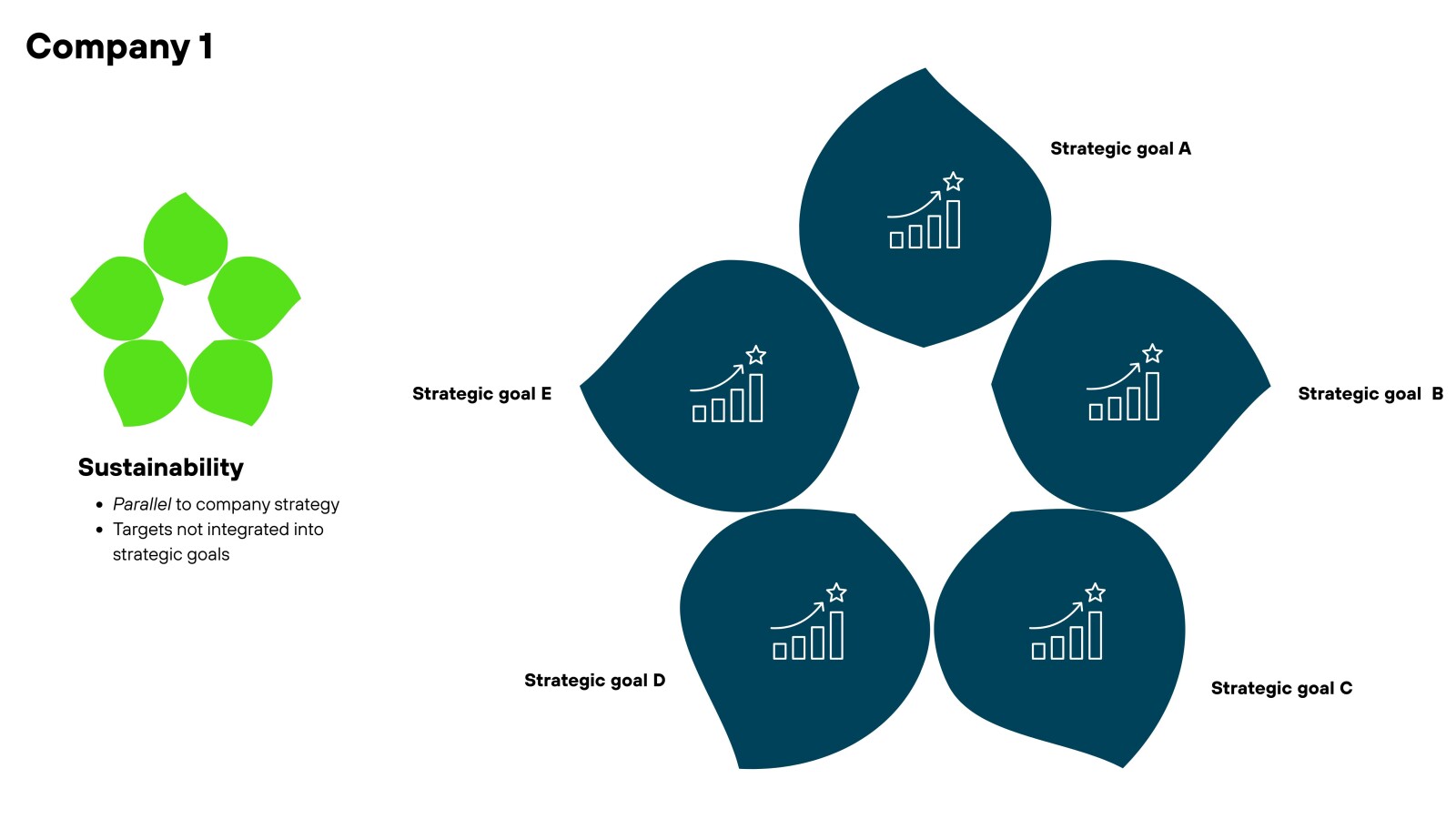

Company 2: Sustainability as one of many strategic goals

Some companies present sustainability as a separate strategic pillar. For example, ABN AMRO shows “Sustainability” as one of its three strategic pillars, without differentiating between the various material topics at the strategy level. Certain topics (such as climate change) are explicitly addressed in the strategy, while others, such as pollution, not.

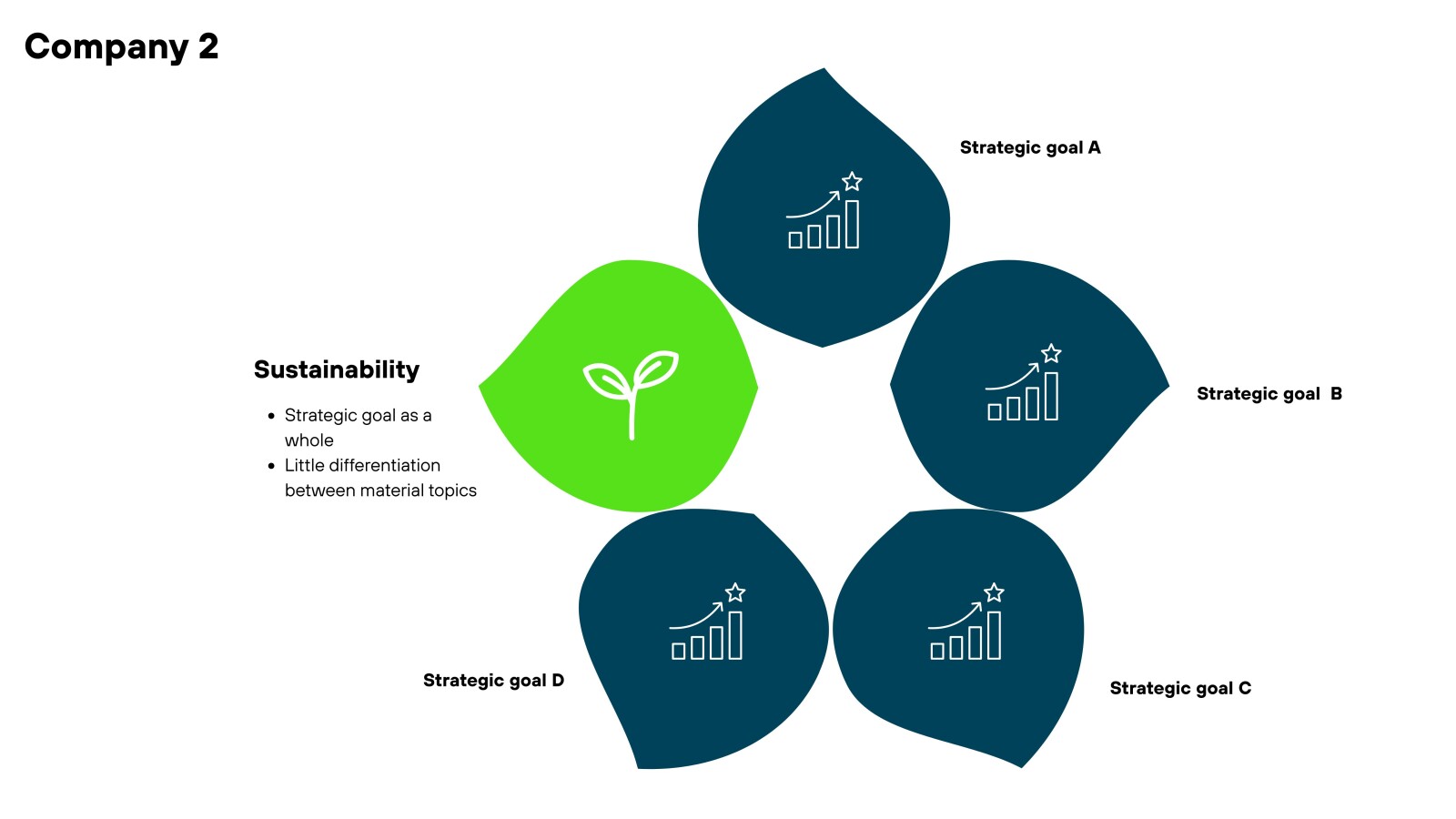

Company 3: Sustainability integrated into some strategic pillars

Other companies link certain material ESG topics to a selection of existing strategic pillars. Not all material topics are integrated. Philips selects a limited number of material ESG topics each year, aligning them with long-term strategic priorities and including auditable, measurable targets. Ahold Delhaize integrates sustainability into broader strategic themes, such as “healthy communities and planet.”

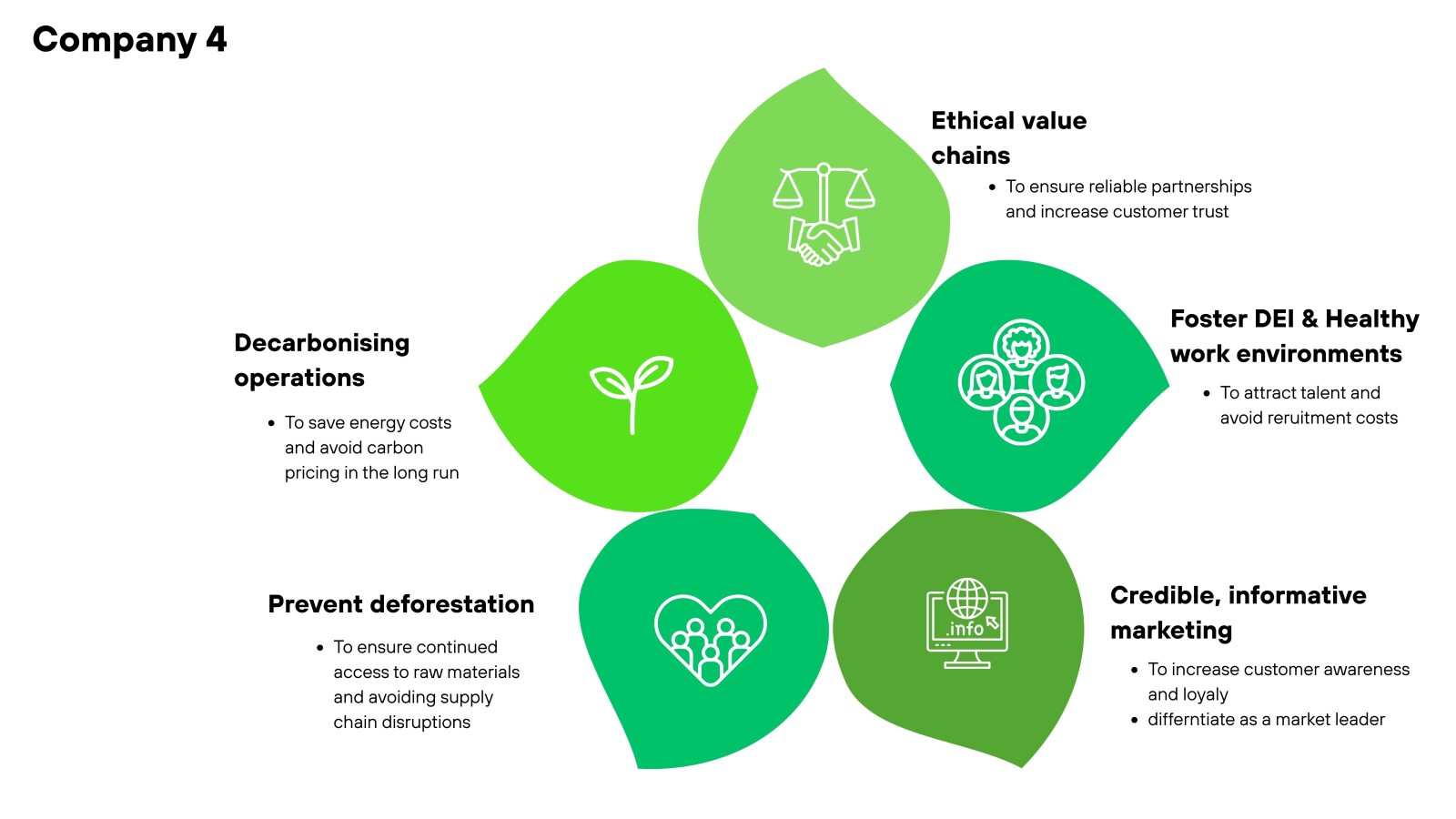

Company 4: Sustainability integrated in mission and all strategic priorities

In this approach, sustainability is embedded in the organization’s mission and influences the core business model and long-term strategy. This is typical for impact-driven companies and social enterprises which purpose it is to make a systemic change in their sector by leading by example. Tony’s Chocolonely and Fairphone integrate sustainability into every aspect of their business ambition.

Are all sustainability topics equally attractive as strategic priorities?

Even mission-driven companies do not always integrate all material topics at the strategic level. Compliance-driven topics, such as pollution, water use, diversity & inclusion, or anti-corruption, may be considered essential but not strategically differentiating. When supported by strong policies, measurable targets, and monitoring mechanisms, such topics can be effectively managed without being elevated to strategic priorities. However, there are cases where compliance is strategic, for instance when a company operates in a highly regulated environment or when its product or service has significant societal or environmental impact. In such contexts, compliance becomes an integral part of competitive positioning and risk mitigation.

Perspectives on evolving your relationship

A robust strategy starts with creating core business value. Depending on the business context, competitive forces can enhance opportunities or mitigate risks to strengthen resilience and create a future-proof strategy.

Most companies primarily pursue opportunity-driven strategies (and why not combine a commercial and sustainable perspective?), such as:

- Developing new products for existing markets. Example: plant-based meat alternatives, lab-grown meat

- Tailoring existing products to new customer segments. Examples: refurbished phones, small solar kits, and water filtering systems for areas where energy and clean water are not available, and a digital energy platform where civilians sell energy to each other.

- Innovating entirely new products and services for new markets. Example: lab-grown leather, excess materials marketplace, 3D printed houses.

Other organizations, depending on their business context, may require a more risk-based strategy. Companies dependent on scarce natural resources must prioritize long-term resource availability to protect future operations. Similarly, companies in heavily regulated and high-impact sectors need to integrate sustainability and responsibility to maintain their licence to operate and mitigate reputational and regulatory risks.

You can see this reflected across industries:

- Nestle links natural-resource protection to its strategic pillar “Investing in key brands and growth platforms.”

- Nederlandse Loterij and Heineken treat responsible gaming and responsible consumption as strategic priorities.

- Microsoft positions data protection and privacy as central to its strategy.

A future-proof strategy makes sustainability inseparable from competitive advantage, and serves a source of resilience and innovation while creating societal value.

In our next blog, we show how to build this alignment. Stay tuned.