Value Creation Model

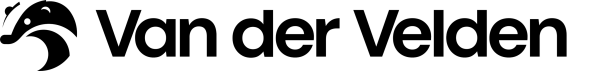

A value creation model illustrates a company's impact on people and the environment, using its value chain. Briefly, it describes:

- INPUTS, like financial resources, employees and raw materials

- The BUSINESS MODEL, which includes activities that use the INPUTS to create:

- OUTPUTS, like products, services and CO2 emissions

- IMPACTS, such as improved quality of life, or reduced resource availability

A value creation model lets you see, at a glance, the value an organisation is creating, maintaining or impairing.

Despite the Integrated Reporting Framework (<IR>) guidelines for value creation models described below, there are big differences in the way these models are set up. TOSCA has delivered many value creation models and has a clear idea of what this should entail. We advocate a cocise text, quantified expression of goals and results - and attractive design. This enables your value creation model to function as a great communication tool that can also be used to inform your employees, customers and other stakeholders. It forces you to separate the main issues from side issues. So it provides a useful summary of your business’s sustainability impact. This, in turn, can be used on your website, as a poster at a reception, or in the CSRD annual report.

What is a value creation model?

The value creation model was introduced by the Integrated Reporting Framework (<IR> framework), the widely-used international framework for integrated reporting from the IFRS Foundation, under which the SASB Standards also fall. The IR Framework and SASB Standards will eventually be replaced by the IFRS Sustainability Disclosure Standards, but in the meantime many companies are using these guidelines for their integrated annual report and value creation model. Integrated reports cover financial results as well as human and environmental impacts. Disclosing the value a company creates, preserves or damages in the short, medium and long term is a fundamental part of the <IR> Framework. The underlying idea is that a company's ability to create value for itself is closely linked to the value it creates for others.

The <IR> Framework uses the six types of capital listed below, to identify value. Companies are not obliged to adhere to this classification, but it provides a useful tool that prevents any forms of capital, and therefore value creation, being overlooked:

- Financial capital: money available for the production of goods or provision of services. Obtained through financing (loans or subsidies), activities and investments

- Produced capital: physical objects needed for the production of goods or provision of services such as buildings, means of transport, plant, roads and bridges

- Intellectual capital: intangible assets such as knowledge, systems, procedures and intellectual property (patents, software, licences)

- Human capital: the competences, capabilities and experience of employees. This also includes elements like company culture

- Social capital: relationships, networks and collaborations with stakeholders, including accumulated trust among stakeholders and corporate reputation

- Natural capital: all the goods and services that nature provides to the business, such as air, water, land, minerals, timber, biodiversity and ecosystems.

The figure below illustrates the relationship between forms of capital and the organisation. This provides the basis for drawing up your own value creation model. In the centre of the diagram, you describe your BUSINESS MODEL. Your business model depends on the forms of capital that serve as INPUT. Your business activities convert this capital into OUTPUTS, such as products, services and waste. The value a business adds or destroys for stakeholders and society as a whole is described under outcomes or, as many companies call it, IMPACT. For example, employee development or reduced availability of raw materials.

Choose your own value creation model framework

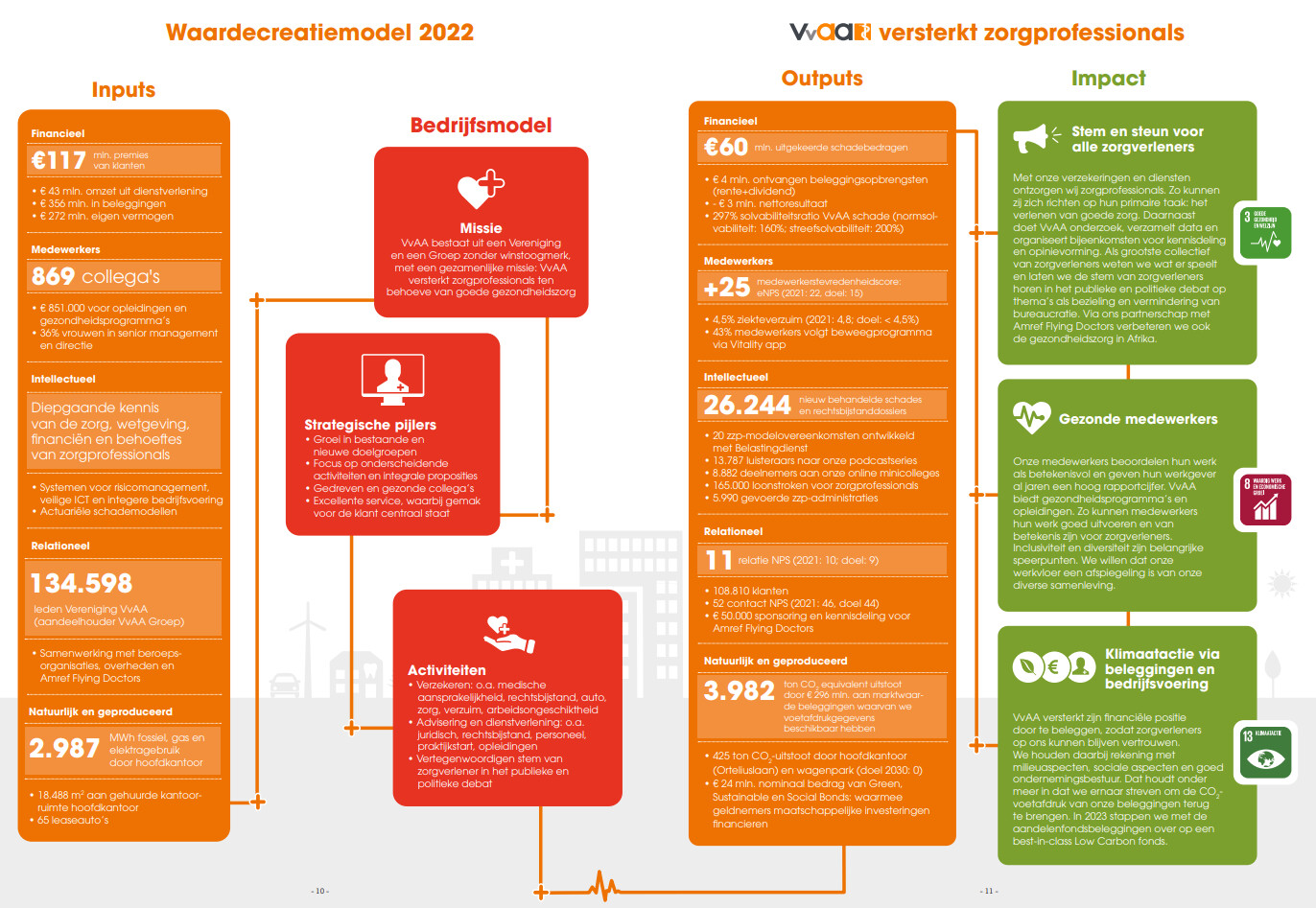

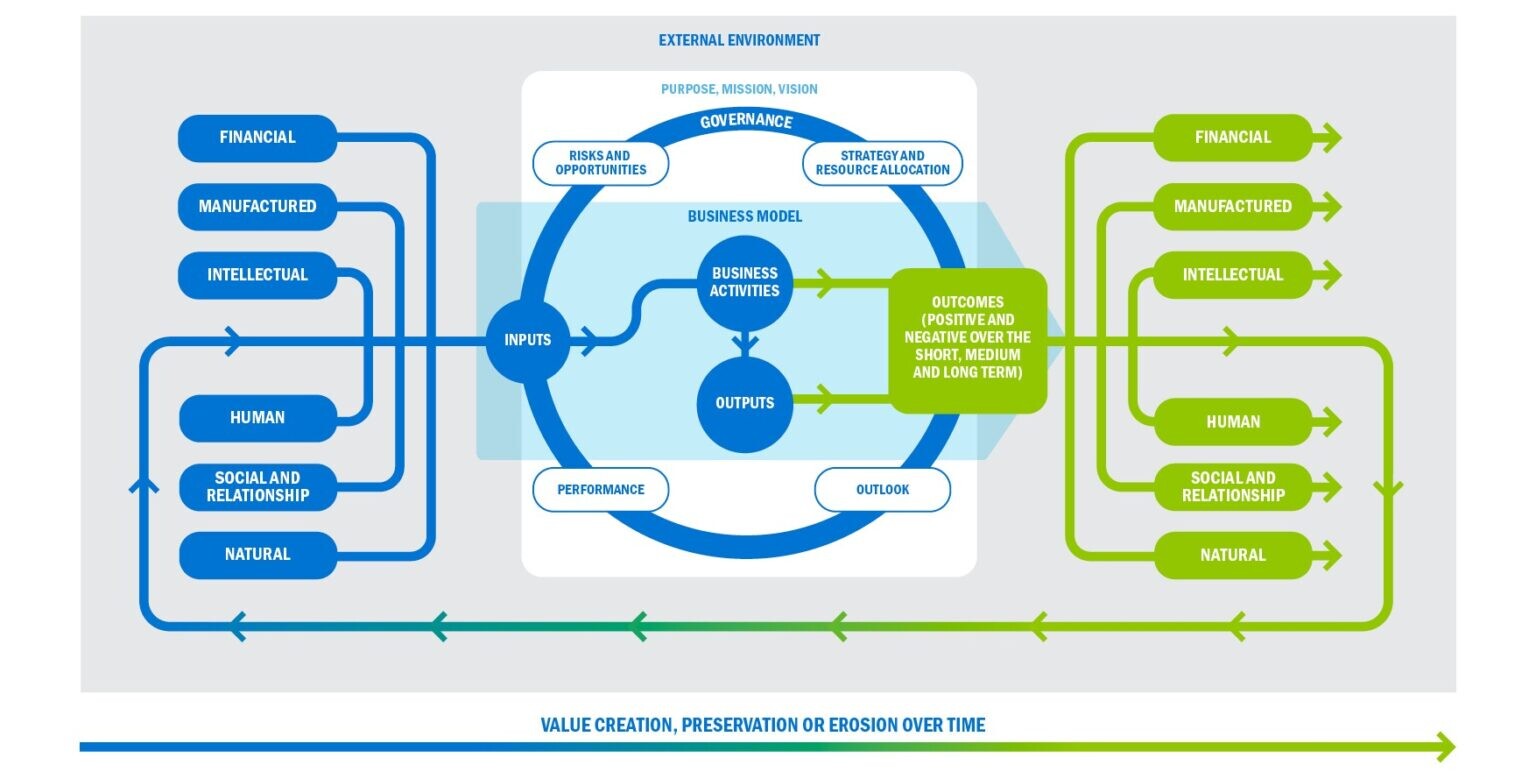

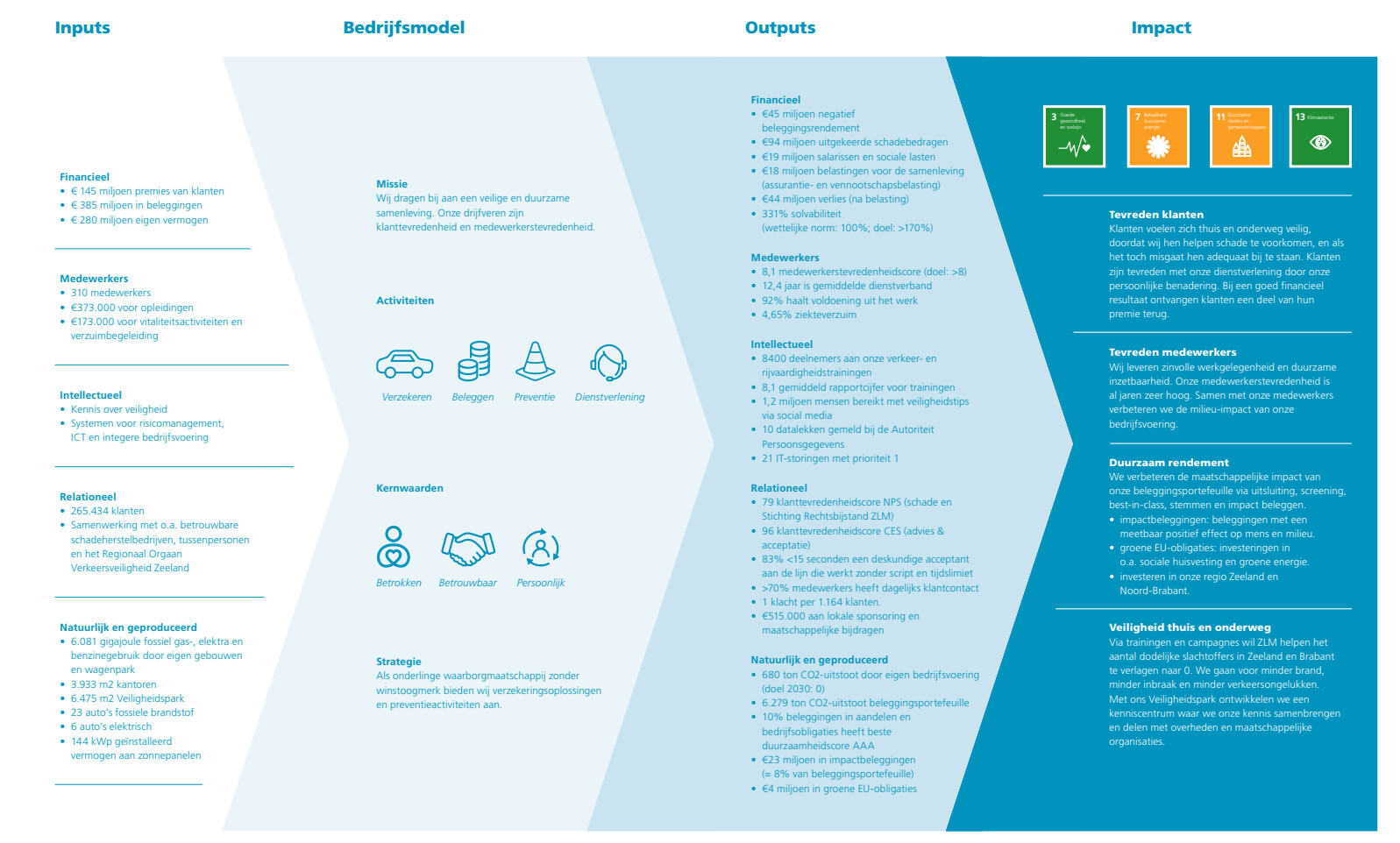

Value creation models come in many forms. Below are three examples, which we made for Erasmus Medical Centre, ZLM insurance, and VvAA. TOSCA is happy to support companies in determining their INPUTS, OUTPUTS and IMPACT. In doing so, we ensure compliance with CSRD requirements, and with guidelines such as <IR> Framework and GRI. At the same time, we create a unique framework for the various themes, in the context of an attractive and unique design that fits your organization.

Waardecreatiemodel Erasmus MC 2022

Waardecreatiemodel 2022 ZLM Verzekeringen