What will change in Integrated Reporting?

What will change after the launch of the new IIRC Integrated reporting framework?

On January 19th 2021, the IIRC launched its revised integrated reporting framework, after receiving input from 1,470 individuals in 55 jurisdictions. Although it may seem that the revisions are just a few wordings that have changed, we believe that this revised model offers great opportunities for companies that want to enhance their value creation story and want to better understand how they can maximize their impact on their stakeholders. In this article we highlight the most important changes, and also share some thoughts in what direction we think Integrated Reporting will move even further in the future.

The improvements the IIRC has made in the framework were divided into three categories:

Clarity

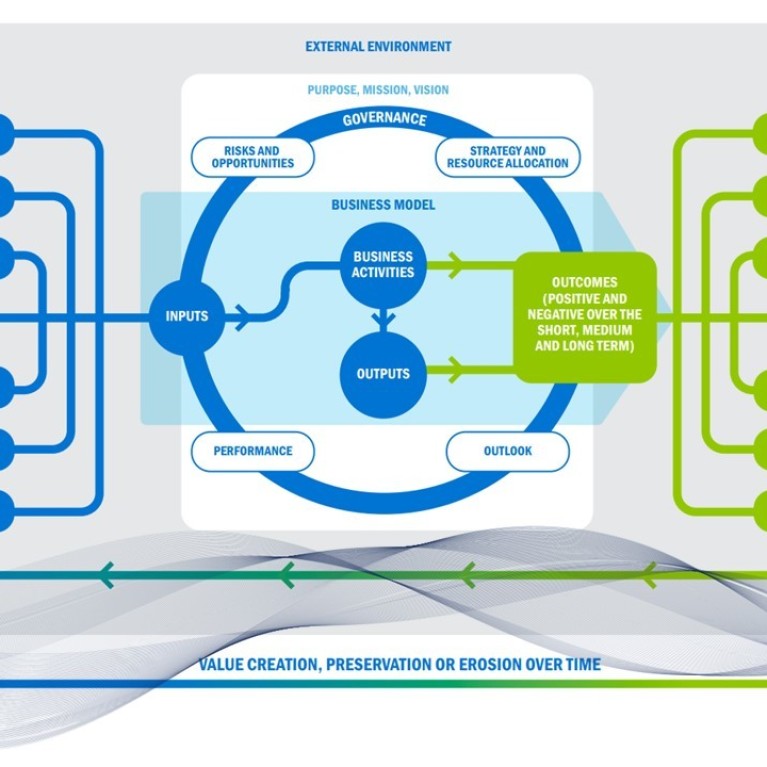

The most important change that has been made was the clarification of the distinction between outputs and outcomes. The IIRC has chosen to give clarity in this respect by including a definition on both terms, supported by a simple example and embedding the terms in the value creation model. We applaud the efforts of the IIRC on guiding companies on this often-perceived difficult area.

Simplicity

There was a lot of feedback from companies on the statement of responsibility, especially from jurisdictions where boards are hold accountable by means of legal claims and where the risk of getting sued for false statements is larger. The IIRC emphasized that boards should be aware that integrated reporting is a journey, and that not everything has to be perfect. This has been emphasized by including that boards should explain to what extend the IIRC-framework has been adopted and which requirements have not been applied and the reason why.

Quality

The most important changes have been made in the field of quality, with the need for balance on the one hand and increasing transparency on robustness of the reporting process on the other hand. With balance the IIRC refers to reporting on both positive and negative outcomes, without bias in the selection or presentation of information. This concept has always been included in the framework, but has been made more explicitly now, in order to enhance the quality of the integrated reports from reporting companies. The value creation story in the integrated report should also be about value preservation and value destruction. In order to increase the transparency on the robustness of the reporting process the IIRC has included additional guidance in the framework on process disclosures and on qualitative and quantitative information. The aim is to get better insight into the integrity of the reporting process, as mentioned by Lisa French, Chief Technical Officer at the IIRC during the webinar. Examples of additional guidance can be found in the clarification on the term balance (“Information in the report is not slanted, weighted, emphasized, de-emphasized, combined, offset or otherwise manipulated to change the probability that it will be received either favorably or unfavorably.”).

Looking at the changes made by the IIRC in the reporting framework, we think that they represent an important improvement of the framework and the model. We applaud that the IIRC has remained true to its philosophy by establishing a principle-based framework, and still give meaningful guidance to organizations on their integrated report at the same time.

It's all about materiality

After the webinar we were left with the question whether the IIRC should have given more clarification on materiality? Integrated reporting starts with determining what is important to report upon, in other words defining what is material and what is not. For instance; recycling coffee cups at a bank is important for employee awareness on sustainability, but is not material for the value creation process of the company. In the revised framework the IIRC defines materiality as matters that substantively affect the organization’s ability to create value over the short, medium and long term. The IIRC states that not all relevant matters are material for the value creation process. To be included in an integrated report, the matter also needs to be sufficiently important in terms of its known or potential effect on value creation based on evaluating the magnitude and its likelihood of occurrence. This requires an in-depth understanding of what really drives pursued outcomes, which transcends mathematical calculations of ultimate financial impacts. For instance, if gender equality at all levels of the company is a pursued outcome, the board must understand what really drives this outcome and report on that. That may well be the presence of a care giving program for young mothers and fathers. Therefor the percentage of employees eligible for this program applying for this kind of program might be the information to be included in the integrated report. Another important dimension of materiality is the double perspective that should be taken into consideration, also called double materiality. Defining what matters to report on, should not only be considered from the perspective of what external effects impact the value creation of the company, but also how the value creation process of the company affects its stakeholders. It’s both inside-out, as well as outside-in.

Conclusion

We think it's up to the reporting companies now to live up to the expectations of investors and other stakeholders to publish meaningful, concise and balanced integrated reports that will ultimately drive sustainable development to the extend needed by the Sustainable Development Goals. Reporting on both positive and negative outputs (ie impacts), and finding the right balance between qualitative and quantitative information, will enable boards to truly understand where they can maximize the value created for all stakeholders.